Keep in mind that there is no demand for teachers with a masters degree plus 45 hours, anywhere. Even public schools are not in the market looking for such highly-paid employees. Why not?

What is fair about a salary that the market will not bear. That statement sounds harsh, but its true.

But, for some reason, folks want to remove public educators from market forces.

-- Jim

By Jim Fedako

Posted on 11/16/2007

[Subscribe or Tell Others]

by Jim Fedako

You hear it from them all the time; teachers just want a fair wage. Well who doesn't? This line of thought leads to two questions: How are wage rates established in a free market? And, are market wage rates fair?

How are wage rates established in a free market? The insights from the Austrian School of Economics show that workers earn their discounted marginal value product. In simple terms, workers earn now the current value of what they add to the production of future goods. That explanation easily fits those who produce consumer goods or factors of production, but what about those in the service sector? How, for example, is the wage rate of barbers established?

In order to understand the service sector we have to consider the alternate cost of employment. The marginal worker, one who can either work in the factory or cut hair, decides which employment to pursue based on relative wages and costs. The cost for working in one field is the wage of the best alternate form of employment in another field. If the cost of working exceeds the benefit, it behooves the worker to seek the alternate field of employment.

If the factory offers better wages, the worker takes the factory job. If cutting hair offers better wages, the worker becomes a barber. If the relative wage rate of barbers begins to exceed the relative wage rate of factory workers, the marginal factory worker switches professions and enters the barber market. By doing this, the wages of barbers would fall as the wages of factory workers rise.

Had the worker stayed in the factory, he would have lost potential earnings. It is the alternate cost of employment, the foregone potential earnings, which guides acting man into the most remunerative employment. And it is this voluntary movement, the change of professions, which tends to guide the labor market toward equilibrium. [1]

This simplistic example shows that service sector employee wages are tied to the discounted marginal value product of labor in general.

Are market wage rates fair? As detailed above, workers earn either their discounted marginal value product or the equivalent wage of their best alternate employment. To say that one wage rate is unfair is to say that the worker earning that rate deserves a premium wage over a similarly productive worker in another sector of the economy. To say that a math teacher is underpaid in a free market is to say that the math teacher deserves to be paid more than the value product of teaching relative to (say) engineering.

In a free market, wages cannot be unfair as they are set by the direction of the consumer. When the alternate cost of employment rises above the wage rate, workers shift sectors and set the labor market back toward equilibrium. [2]

In order to gain a wage premium, government interventions must occur. These interventions can take the form of field or general minimum wages, granting unions legal right to control sectors of the economy, government wage supports, or the creation of a government monopoly or quasi-monopoly in a sector of the economy – the school system for example.

In a free market teachers would also earn the equivalent of their discounted wage in the productive sector of the economy. A math teacher would earn the equivalent wage of a similarly productive worker in (say) the software industry – who earns the equivalent wage of a similarly productive worker in the engineering industry, and so on. If the math teacher was underpaid relative to his best alternate employment, this would be a signal there is an excess of math teachers, and that math teachers are being underutilized in their current employment.

But the teacher market is not free; it is a quasi-monopoly where the vast majority of employees are unionized under a government-run system. Unlike the Soviet Union, which used the free markets of the world to establish some sort of price level, public schools do not look to private schools for wage guidance. Private schools pay their workers a much lower wage, but as above, they must pay a wage that exceeds the alternate costs of employment. [3]

Are public school teachers overpaid? Since there is no way to discern the true alternate cost of employment for all public school teachers in a free market – because no free market for teachers exists – we must rely on the available market data provided by private schools. This shows that teachers are, in general, overpaid.

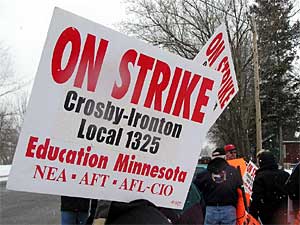

In addition, and more importantly, we know a priori that governments are inefficient and over-pay and over-employ factors of production. Also, government teaching licensure rules create barriers to entry for those wishing to seek out a teaching career, thus driving wage rates higher. Then, of course, there are the government-backed unions who rule the roost through strikes and threats of strikes. [4]

Are public teacher salaries unfair? Certainly. They are unfair to the taxpayer who is forced to pay the tax bill that supports the premium wage of public school teachers. In a free labor market a teacher's real salary can only increase with the marginal value product of employees in the next best alternate employment. In the quasi-monopoly that currently exists, teachers have realized salary increases that are not tied to the labor market; the salary increases are simply the result of political pressure.

The next time you hear teachers claim that they need a fair wage, tell them to drop the union banners and open education to the free market; the one market where everyone earns their fair wage.

[1] Of course the opposite holds if the factory worker made relatively more than the barber. Professions would switch and wages would tend toward equilibrium.

[2] Equilibrium is the direction of the movement, not reality. Equilibrium is the infinite endpoint on the continuum that is never reached though the actions of individuals tend to keep the economy moving in that direction. As consumer preferences change, the economy is rocked away from the direction of equilibrium, but the vast numbers of astute entrepreneurs act quickly to satisfy these new preferences and bring the economy back on course – well, in an unhampered market anyway. Government likes to damage the rudder in such a manner that even the most astute entrepreneur cannot set a new course.

[3] Certainly there is an additional psychic income earned due to the rewards of teaching, but the psychic income exists in both the private and public school market. In fact, every job has its own form of psychic income that is based purely on the subjective valuation of the employee.

[4] Everyone has a study that shows teachers are either overpaid or underpaid based on salary and benefits per number of hours worked in a given year. Conflicting studies are the product of the current empiricist/positivist paradigm. The only way to read through the data and understand economics and the impact of policies is to use the a priori approach to understanding of the Austrian School.

Zoning is theft, pure and simple. In his fantastic introduction to the Austrian School,

Zoning is theft, pure and simple. In his fantastic introduction to the Austrian School,